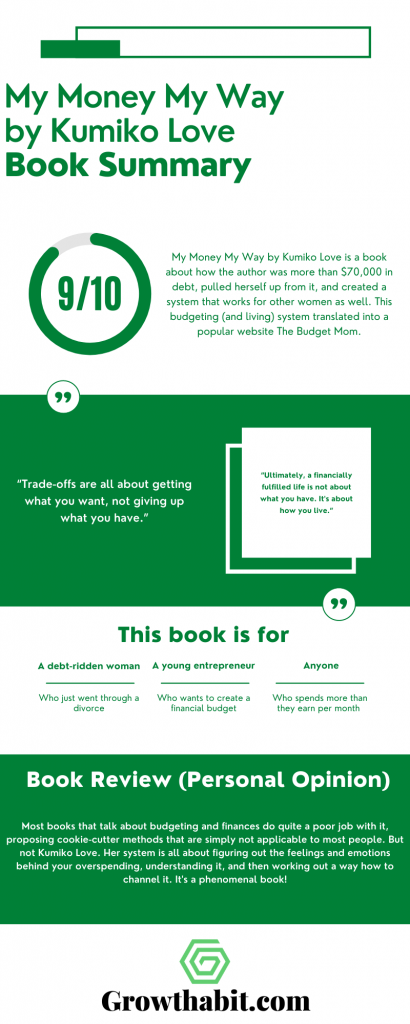

My Money My Way by Kumiko Love is a book about how the author was more than $70,000 in debt, pulled herself up from it, and created a system that works for other women as well. This budgeting (and living) system translated into a popular website The Budget Mom.

Book Title: My Money My Way: Taking Back Control of Your Financial Life

Author: Kumiko Love

Date of Reading: March 2022

Rating: 9/10

What Is Being Said In Detail:

My Money My Way is divided into two sections and thirteen chapters.

The first two chapters are introductory chapters and then the book starts with Part One, Build A New Foundation. This section has three chapters and then Part Two, Make It Happen, continues with the eight remaining chapters.

CHAPTER ONE: The Ice Cream Cone That Changed My Life

The first chapter tells the story of how Kumiko Love came to the lowest point in her life, looking at her son who wanted ice cream from McDonald’s and not knowing if she can afford it. It goes through her divorce and how she managed to put herself together, becoming The Budget Mom.

CHAPTER TWO: Money Anxiety Isn’t about Money

The second chapter talks about the scarcity mindset and how to change it to an abundance mindset. It’s not about numbers and calculators, it’s about feelings and strategy. Kumiko tells the story of one of her readers, Ashley, and how she managed to reframe the question of “how much I need to save” to “what matters to me?” This is what made the difference in her approach and in her results.

CHAPTER THREE: Start by Answering This Question

The third chapter is all about figuring out your Why behind getting your finances in order. The author gives a three-step process on figuring out your why: 1. Start with a goal and then ask the next question (so what?), 2. Make the goal bigger than yourself, 3. Attach a visual to it so that you have a reminder.

CHAPTER FOUR: The Real Reason You Buy (Hint: You Don’t Like H&M That Much)

The fourth chapter is about realizing what kind of a spender are you. The chapter follows the story of Cassie and how she managed to get her finances in order. There are a couple of types of spenders: The Recycle spender, The Hoarder, The Compulsive buyer, The Impulsive spender, The FOMO spender, The Magnify shopper, and The Bored buyer.

CHAPTER FIVE: The $1,000 Manicure—and Highlighting Your Blind Spots

The fifth chapter talks about two major factors that shape how we acquire, spend, and manage our money: learned behavior from childhood (from parental figures) and our personal experiences. It’s about having balance in all three of those areas and you can do it by tracking your expenses, creating budget categories, and getting curious about your spending by self-reflecting.

CHAPTER SIX: Discover Your True Priorities (When Everything Feels Important)

The sixth chapter starts with the story about Tammie who learned from her father to get financial priorities straight. When discovering your priorities (big-picture budgeting items), you should always have a (kickoff) emergency fund to keep you afloat in case of unexpected things. There are three types of priority goals: short-term (1-3 years), medium (3-7 years), and long-term (7-10+ years). this chapter also mentions a sinking fund: A sinking fund is for a planned, expected event in your life. A sinking fund is a strategic way to save a little bit of every paycheck to pay for planned large expenses.

CHAPTER SEVEN: A Budget for Your Real Life, Not the “Perfect” Version

The seventh chapter starts with Casey’s story on how she had everything worked out perfectly on paper, but in real-life, it became a mess. But when you use a budget calendar, it will help you navigate through real-life situations with three steps: record money coming in, record money going out, and budget by paycheck.

CHAPTER EIGHT: Avoid Budget Burnout

The eighth chapter starts with Shonya’s story on how a rigid budge deprived her of everything fun in life, and how all of that changed when she found out The Budget Mom and learned how to properly budget the finances. This chapter is all about creating budgets that are sustainable and won’t lead you to burnout.

CHAPTER NINE: Become an Intentional Spender

The ninth chapter starts with Michelle’s story and how she struggled at first, but later became a mentor to many members in the TBM group. This chapter introduces The Cash Envelope System, a way to budget that involves putting money into marked envelopes (such as grocery, gas, or pets) and using them as a way to track your spending.

CHAPTER TEN: Defeat Your Debt

The tenth chapter is all about defeating debt and the four steps to deal with it are facing your debt head-on, figuring out your payment priorities (avalanche method, where you pay the highest interest rate first, or the snowball method, where you pay the lowest balance first), using the rollover effect (money that you used to pay one debt rolls over to the next debt), and updating everything accordingly.

CHAPTER ELEVEN: Begin Your Retirement Journey

The eleventh chapter is all about creating retirements funds. Kumiko talks about investing in 401(k), HSA (health savings account), and both traditional IRA and ROTH IRA.

CHAPTER TWELVE: Invest in Yourself

The twelfth chapter talks about investing. It’s about finding the process that works for you, whether it’s active investing such as mutual funds or day trading or passive investing such as ETFs or index funds. The author mentions that she herself uses ETFs and index funds and plays for the long run.

CHAPTER THIRTEEN: Live a Life You Love

The last, thirteenth, chapter is all about sending the message that a good life isn’t lived by spending less, but by spending well. It’s about finding financial stability to have the freedom to live the way you want to live.

Most Important Keywords, Sentences, Quotes:

“The Ice Cream Cone That Changed My Life”

“We were at the park. My son wanted ice cream. We got in the car and drove to the closest McDonald’s. I pulled up to the window and ordered one. I will never forget the price: $1.09. As I went to pay, I reached inside my wallet and pulled out my debit card, but then hesitated: I didn’t even know if I had $1.09 in my checking account. So I took out my credit card instead. I financed a $1.09 ice cream cone for my son.”

“Money Anxiety Isn’t about Money”

“Once you know what you truly want—what brings real value to your life —you will know how much is enough.”

“Start by Answering This Question”

“What is the reason behind the goal? Or, even better, what’s the reason behind the reason?”

“Motivation is the kick-starter, but it can never guarantee success. If you want a true, long-lasting financial transformation, you have to discover and practice discipline.”

“The Real Reason You Buy (Hint: You Don’t Like H&M That Much)”

/

“The $1,000 Manicure—and Highlighting Your Blind Spots”

“This underlines an important facet of the Budget by Paycheck system: it’s not about deprivation, but about thoughtful investment.”

“Discover Your True Priorities (When Everything Feels Important)”

“A sinking fund is for a planned, expected event in your life. A sinking fund is a strategic way to save a little bit of every paycheck to pay for planned large expenses.”

“A Budget for Your Real Life, Not the “Perfect” Version”

/

“Avoid Budget Burnout”

“If your budget is making you more intentional with your money, however, and is giving you signs of progress, then that’s a success. It’s working.”

“Become an Intentional Spender”

/

“Defeat Your Debt”

“Sometimes, you can settle for a lump-sum payment and get an even better deal. Collection agencies buy debts for pennies on the dollar. When you call a debt collector and offer to settle a collection account in one lump sum, you might be able to save as much as 50 percent or more off the debt. (Secrets everyone should know, right?)”

“Trade-offs are all about developing self-awareness. You analyze what really brings value to your life versus the habits you’ve developed in life, and you start making thoughtful exchanges.”

“Bottom line: do you have to make sacrifices when you’re paying off debt? Absolutely. Do you have to give up everything? No. And you’re going to decide how much you are willing to give up.”

“Trade-offs are all about getting what you want, not giving up what you have.”

“Begin Your Retirement Journey”

“Just because everyone does something doesn’t make it a good idea; it makes it a popular idea.”

“Invest in Yourself”

/

“Live a Life You Love”

“The biggest marker of a financially fulfilled life is a person’s ability to give their time, focus, and energy generously to those they love.”

“Ultimately, a financially fulfilled life is not about what you have. It’s about how you live.”

Book Review (Personal Opinion):

Most books that talk about budgeting and finances do quite a poor job with it, proposing cookie-cutter methods that are simply not applicable to most people. But not Kumiko Love. Her system is all about figuring out the feelings and emotions behind your overspending, understanding it, and then working out a way how to channel it. It’s a phenomenal book!

Rating: 9/10

This Book Is For (Recommend):

- A debt-ridden woman who just went through a divorce

- A young entrepreneur who wants to create a financial budget

- Anyone who spends more than they earn per month

If You Want To Learn More

Here’s Kumiko Love talking about her book with Marie Forleo.

Financial Advice for REAL Life

How I’ve Implemented The Ideas From The Book

I’ve kept a budgeting calendar from 2018 and it works wonders. I know where I spend most of my money and it’s in the category where I want to spend the most–food! 🙂

One Small Actionable Step You Can Do

Start tracking your finances for a month. It will do wonders!