Book Title: I Will Teach You To Be Rich, Second Edition: No Guilt. No Excuses. No BS. Just a 6-Week Program That Works

Author: Ramit Sethi

Date of Reading: June-July 2019

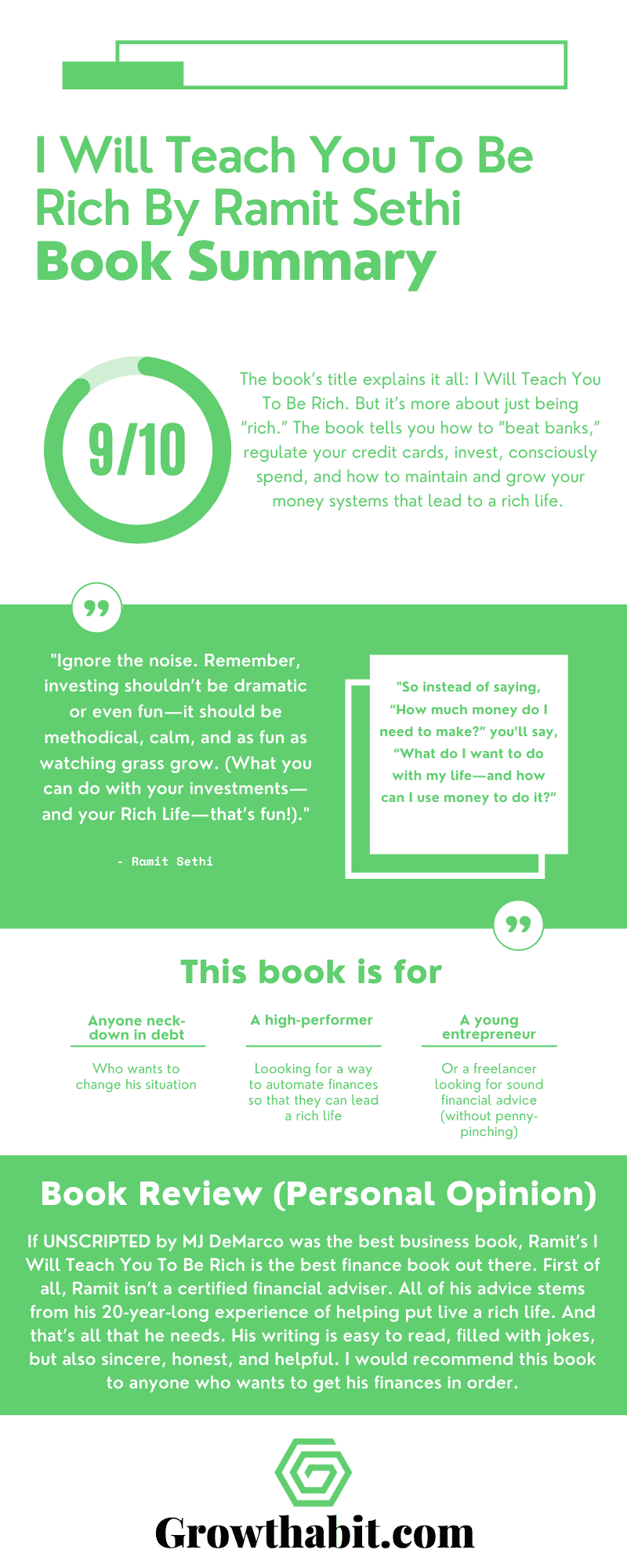

Rating: 9/10

What Is The Book About As A Whole:

The book’s title explains it all: I Will Teach You To Be Rich. But it’s more about just being “rich.” The book tells you how to “beat banks,” regulate your credit cards, invest, consciously spend, and how to maintain and grow your money systems that lead to a rich life.

What Is Being Said In Detail:

The book is structured like a six-week program where you take action steps after each week. It’s not about reading the book, but about changing your life situation regarding money and finances.

Week 1 (chapter 1) concentrates on setting up your credit cards, paying off your debt (if possible), and learning how to master your credit history.

Week 2 (chapter 2) will help you set the right bank accounts (savings account, high-interest, no-fees accounts).

Week 3 (chapter 3) will jumpstart your investment by opening a 401(k) and Roth IRA even if you just have $100.

Week 4 (chapter 4) will help you figure out how much you’re spending. You’ll learn the difference between cheap people and conscious spenders.

Week 5 (chapter 5) will focus on automating your finances. How to make money while you sleep, and only spend 90 minutes a month managing your money.

Week 6 (chapters 6 & 7) will teach you why investing isn’t the same as picking stocks. It will teach you how to get the most out of the market with the least amount of work.

These chapters will also mention the FIRE movements, active and passive management, and creating your own portfolio.

The last two chapters (8 & 9) will focus on maintaining and growing your system. You will learn how to create a ten-year-long plan, how to ignore the noise out there, how to negotiate a salary, and the finances of relationships.

Most Important Keywords, Sentences, Quotes:

I dunno, guys. I prefer advice that actually works. And when I took a hard look at the advice I gave in this book a decade ago, I realized one thing: I was right.

For example, your Rich Life might be to live in Manhattan. It might be to ski forty days a year in Utah, or to save and buy a house with a huge yard for your kids, or to fund an elementary school in Croatia. That’s your choice.

Just as you don’t have to be a certified nutritionist to lose weight or an automotive engineer to drive a car, you don’t have to know everything about personal finance to be rich. I’ll repeat myself: You don’t have to be an expert to get rich.

As you can see, I don’t have a lot of sympathy for people who complain about their situation in life but do nothing about it.

That’s why I wrote this book! I want you to be empowered to take control of your situation, no matter where in life you started from.

So instead of saying, “How much money do I need to make?” you’ll say, “What do I want to do with my life—and how can I use money to do it?”

There’s a difference between being sexy and being rich.

When I hear people talk about the stocks they bought, sold, or shorted last week, I realize that my investment style sounds pretty boring: “Well, I bought a few good funds five years ago and haven’t done anything since, except buy more on an automatic schedule.”

But investment isn’t about being sexy—it’s about making money, and when you look at investment literature, buy-and-hold investing wins over the long term, every time.

There’s a limit to how much you can cut, but no limit to how much you can earn.

Sometimes the most advanced thing you can do is the basics, consistently.

I have a lot of compassion for people in debt. Some are in tough life situations. Some don’t understand how credit cards work.

Some people have debt spread out over multiple credit cards and student loan accounts. Almost everyone is trying to do their best. But I have no sympathy for people who complain without a plan.

And a plan means that if you’re in debt, you should know how much you owe and the exact day your debt will be paid off. Almost nobody does.

You’ll notice that I haven’t offered you a simple secret or cute sound bite about how to pay off your debt with no work. That’s because there isn’t one. If there were, I would be the first to tell you.

The real lesson is: When companies—and people—show you who they truly are, believe them.

On the other hand, there are companies that consistently demonstrate excellent values. Schwab rolled out a phenomenal high-interest checking account years ago that offered unrivaled benefits for free.

They’ve honored it and improved it over time. I trust them and have a checking account with them. Vanguard has consistently demonstrated a long-term focus on low costs and putting their clients first.

They actually lower fees proactively. I trust them and invest with them.

UP-SELLS to expensive accounts (“Expedited customer service! Wow!”). Most of these “value-added accounts” are designed to charge you for worthless services.

I can’t wait to have kids one day so my three-year-old can walk into a Wells Fargo, throw his lollipop at the bank manager, and say “THIS ACCOUNT IS CLEARLY A RIP-OFF!” Good job, little Raj.

After years of talking to young people about money, I have come to a couple of conclusions: First, I pretty much hate everyone.

Second, I believe there are three categories of people: the As, the Bs, and the Cs. The As are already managing their money and want to optimize what they’re doing.

The Bs, the largest group of people, are not doing anything but could be persuaded to change that if you figure out what motivates them. The Cs are an unwashed mass of people who are a lost cause.

Of America’s millionaires, two-thirds are self-made, meaning their parents weren’t rich.

They collected their significant wealth through controlling their spending, regular investing, and, in some cases, entrepreneurship. Not as sexy as winning the lottery, but much more realistic.

I believe Vanguard has the edge, and I invest through them.

But realize this: By the time you’ve narrowed down your investing decision to a low-cost provider like Vanguard or a robo-advisor, you’ve already made the most important choice of all: to start growing your money in long-term, low cost investments.

Whether you choose a robo-advisor or Vanguard or another low-fee brokerage is a minor detail. Pick one and move on.

Let’s first dispense with the idea that saying no to spending on certain things means you’re cheap.

If you decide that spending $2.50 on Cokes when you eat out isn’t worth it—and you’d rather save that $15 each week for a movie—that’s not being cheap. That’s consciously deciding what you value.

DOES MONEY MAKE US HAPPY?

Yes! I know, I know. You may have heard about a study that found money makes us happy up to $75,000, then it levels off.

In reality, the 2010 study by Deaton and Kahneman found that “emotional well-being” peaks at $75,000.

But if you take another measure, “life satisfaction,” you find no plateau—not at $75,000, or $500,000, or even $1 million.

Fixed costs are the amounts you must pay, like your rent/mortgage, utilities, cell phone, and student loans. A good rule of thumb is that fixed costs should be 50 to 60 percent of your take-home pay.

Well, Richard Jenkins, the former editor-in chief of MSN Money, wrote an article called “The 60 Percent Solution,” which suggested that you split your money into simple buckets, with the largest, basic expenses (food, bills, taxes), making up 60 percent of your gross income.

The remaining 40 percent would be split four ways:

1. Retirement savings (10 percent)

2. Long-term savings (10 percent)

3. Short-term savings for irregular expenses (10 percent)

4. Fun money (10 percent)

Do you know people who get so obsessed with something new that they go completely overboard and burn out? I would rather do less but make it sustainable.

I once had a woman who emailed me saying, “I always tell myself I want to run three times a week, but I never go.” I wrote back and said, “What about going for a run once a week?”

She replied, “Once a week? What’s the point?” She would rather dream about running three times a week than actually run once a week.

This idea of sustainable change is central to personal finance. Sometimes I get emails from people who say things like, “Ramit! I started managing my money! Before, I was spending $500 a week! Now I only spend $5 and I save the rest!” I read this and just sigh.

Although you might expect me to get really excited about someone contributing $495/month to their savings, I’ve come to realize that when a person goes from one extreme to another, the behavioral change rarely lasts.

I don’t know about you, but I plan to do less and less work as I go through my life. When I meet people on a career path that will have them working more, not less, I’m always puzzled.

That’s like being a real-life Mario Brother, where every level you beat means your life gets progressively more difficult. Why would you want that?

Add a savings goal of three months of bare-bones income before you do any investing.

For example, if you need at least $3,500/month to live on, you’ll need to have $10,500 in a savings buffer, which you can use to smooth out months where you don’t generate much income.

First, forget about investing while you’re setting up the buffer, and instead take any money you would have invested and send it to your savings account.

Second, in good months, any extra dollar you make should go into your buffer savings.

We’re taught that experts deserve to be compensated for their training and experience.

After all, we wouldn’t hire someone off the street to build a house or remove our wisdom teeth, would we? But ultimately, expertise is about results.

Starting in 2000, S&P Dow Jones Indices did a sixteen-year study and found that the fund managers who beat their benchmarks one year had an extremely difficult time getting similar returns the next year.

“If you have an active manager who beats the index one year, the chance is less than a coin flip that the manager will beat the index again next year,” said Ryan Poirier, senior analyst at S&P Dow Jones Indices.

The only long-term solution is to invest regularly, putting as much money as possible into low-cost, diversified funds, even in an economic downturn.

This is why long-term investors have a phrase they use: Focus on time in the market, not timing the market.

Now, there are indeed investors who have beaten the market consistently for years. Warren Buffett, for example, has produced a 20.9 percent annualized return over fifty-three years.

Peter Lynch of Fidelity returned 29 percent over thirteen years. And Yale’s David Swensen has returned 13.5 percent over thirty-three years.

If you’re currently working with a financial adviser, I encourage you to ask them if they are a fiduciary (i.e., if they’re required to put your financial interests first).

Want to play a fun game? Ask your parents what their investment fees are. They don’t know, and if they found out what it actually cost them, they would be depressed. On second thought, don’t do this.

Most index funds stay close to the market (or to the segment of the market they represent). Just as the stock market may fall 10 percent one year and gain 18 percent the next year, index funds will rise and fall with the indexes they track.

The big difference is in fees: Index funds have lower fees than mutual funds, because there’s no expensive staff to pay. Vanguard’s S&P 500 index fund, for example, has an expense ratio of 0.14 percent.

John Bogle, the Vanguard founder, once shared a shocking example with PBS documentary series Frontline. Let’s assume you and your friend Michelle each invested in funds with identical performance over fifty years.

The only difference is that you paid 2 percent lower fees than she did. So your investment returned 7 percent annually, while hers returned 5 percent.

What would the difference be? On the surface, 2 percent in fees doesn’t seem like much. It’s natural to guess that your returns might differ by 2 percent or even 5 percent.

But the math of compounding will shock you. “Assuming a fifty-year horizon, the second portfolio would have lost 63 percent of its potential returns to fees,” Mr. Bogle said. Think about that. A simple 2 percent in fees can cost you over half of your investment returns.

Automatic investing is not some revolutionary technique that I just invented. It’s a simple way of investing in low-cost funds that is recommended by Nobel Laureates, billionaire investors such as Warren Buffett, and most academics.

For example, I know several people who had automatic investment plans, and when the stock market incurred huge losses in late 2008, they immediately canceled their investments and took their money out of the market. Big mistake.

The test of a real automatic investor is not when things are going up, but when they are going down.

For example, in October 2018, the stock market dropped and one of my investment accounts decreased by more than $100,000. I did what I always do—kept investing, automatically, every single month.

What about the downside of the money they’re losing every day by not investing? Ask your friends what the average return of the S&P 500 has been for the past seventy years.

How much money would they have if they invested $10,000 today and didn’t touch it for ten years—or fifty years? They won’t know, because they don’t even know the basic return rate to assume (try 8 percent).

When people say investing is too risky, it’s because they don’t know what they don’t know.

Imagine one day you woke up and you had enough money in your accounts to never work again.

In other words, your investments were generating so much money that your money was actually producing more money than your salary.

That’s the Crossover Point, first described by Vicki Robin and Joe Dominguez in their book, Your Money or Your Life.

As one redditor wrote:

“I look back at the past few years of my life and at my bank account and I would gladly give away a hefty chunk of it and work longer if it meant I could have experienced more of the world and found more passions I could have for the rest of my life, especially with someone I had loved so much. I built my savings, but I never built my life.”

Bonds act as a counterweight to stocks, generally rising when stocks fall and reducing the overall risk of your portfolio.

By investing part of your money in bonds, you reduce some of your overall risk. Sure, if that biotech stock went up 200 percent, you’d wish your bond money was all in the stock —but if the stock went down, you’d be glad your bonds were there as a buffer against losing everything.

Today, index funds are an easy, efficient way to make a significant amount of money.

Note, however, that index funds simply match the market. If you own all equities in your twenties and thirties and the stock market drops (like it has from time to time), your investments will drop. Expect it!

It’s normal for your investments to go up and down. Over the long term, the stock market has always gone up.

The Rule of 72 is a fast trick you can do to figure out how long it will take to double your money.

Here’s how it works: Divide the number 72 by the return rate you’re getting, and you’ll have the number of years you must invest in order to double your money. (For the math geeks among us, here’s the equation: 72 ÷ return rate = number of years.)

If you had to get extremely specific about why you want to earn your next $10,000 and you had to bring your answer from the clouds to the street, what would you say? What’s your street-level motivation?

Ignore the noise. Remember, investing shouldn’t be dramatic or even fun—it should be methodical, calm, and as fun as watching grass grow. (What you can do with your investments—and your Rich Life—that’s fun!)

Share this Image On Your Site

Book Review (Personal Opinion):

If UNSCRIPTED by MJ DeMarco was the best business book, Ramit’s I Will Teach You To Be Rich is the best finance book out there. First of all, Ramit isn’t a certified financial adviser.

All of his advice stems from his 20-year-long experience of helping put live a rich life. And that’s all that he needs. His writing is easy to read, filled with jokes, but also sincere, honest, and helpful.

I would recommend this book to anyone who wants to get his finances in order.

Rating: 9/10

This Book Is For (Recommend):

- Anyone neck-down in debt who wants to change her situation

- A high-performer looking for a way to automate finances so that they can lead a rich life

- A young entrepreneur or a freelancer looking for sound financial advice (without penny-pinching)

If You Want To Learn More

Ramit’s a funny guy and here’s one of his talks at Google.

Ramit Sethi, Talks at Google

How I’ve Implemented The Ideas From The Book

Most financial books ignore gig workers so I usually don’t get that much from them. But Ramit is smart.

He concluded freelance and gig workers into his advice so I actually got some advice that’s helpful for my situation (save a years-worth income before starting an automated investment fund). So I’m currently in the savings portion of the advice.

One Small Actionable Step You Can Do

One thing you shouldn’t create is a budget. Nobody follows a budget.

But the one thing you can do that will actually have an effect on your spending and earning is tracking your finances.

Start by tracking your expenses for a single month. Write down every single expense you had that month. That way, you will know what you spend your money on, how much you spend, and where can you spend less money the next month.