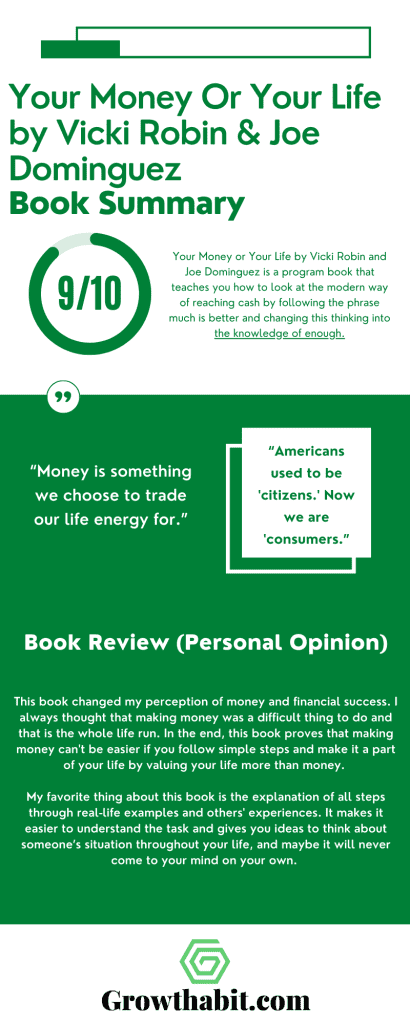

Your Money or Your Life by Vicki Robin and Joe Dominguez is a program book that teaches you how to look at the modern way of reaching cash by following the phrase much is better and changing this thinking into the knowledge of enough.

Book Title: Your Money Or Your Life

Authors: Vicki Robin & Joe Dominguez

Date of Reading: June 2022

Rating: 9/10

What Is Being Said In Detail:

This is the book that provides a 9-step program, and it doesn’t learn you just about reaching more money, but also knowing what is ‘more’ and ‘money’ in your life, and how much importance and energy you are giving to it. In summary, it has four-FIs to present and teach you:

– Financial Intelligence

– Financial Integrity

– Financial Independence

– Financial Interdependence

The book is divided into nine chapters and each one talks about one step of this program.

Foreword

Foreword, together with the introduction to the new edition, gives a brief view into the methods this book was written and works on various sorts of people since the author by himself tried to find a target group and speak with people to see the main financial problems in the world.

Chapter One: “The Money Trap: The Old Road Map for Money”

Chapter 1 set up the problem modern society in the 21st century has: watching everyone’s life through money and income.

We think we make better if we do more, but the sad truth is that we reduce our life to eight-to-ten working hours, sleep, weekend purchase, and luxury dinner we are happy we can afford.

And we always think we need more to be happy and to be enough. Why? Because we are looking at our main income as black-and-white income with which we would pay our bills and basic life needs, and that is all.

So, the first step to talking about money on the other side of the plate is – awareness. How much we earned in our life, not just from work, but every single income we made since our high school mini jobs.

And, how much do we have from that money right now? But not that easy, money isn’t just your cash in your pocket and your bank account – it is all the valuable things you have in your home, garage, cottage, and so on.

Become aware of your money’s worth, and ask yourself why you have all these things in that shape, and not in the paper cash if you value that the most your whole life. Or, do you really do?

Chapter Two: “Money Ain’t What It Used to Be—and Never Was”

Chapter 2 teaches you about the actual point money has in your life. Ask yourself a question, dear reader, what is the purpose of money? In the world? And in your life?

What you can buy with money, and what is important to you that you cannot have without money. And the right answer, with the arguments from this part of the book, is money=your life energy.

Every single thing you buy, you buy it with your time and energy, not the money. So, the second step for becoming stressless about money is to be clear about your income – but your real hourly wage. How to calculate it?

First, calculate how much money/energy/time you are spending on transport, clothes, food, and special needs you wouldn’t have without the work you do.

It can be 50% of the hourly wage you think you had, and it is okay – I hope. It is important, one time you calculated it, you became aware of your income, and you start tracking every single cent you earn or spend!

Chapter Three: “Where Is It All Going?”

Chapter 3, as the name says, provides you with the method you will use to keep track of your monthly expenses. Maybe you already do that or did some time, but let me guess, you had a simple 3-4 category list named something like food, transport, rent, clothes.

And you simply have some approximate values for each of them, but at the end of the month, you weren’t sure if you need the same amount for each category next month.

The solution is to have more precise categories, and as many subcategories as you need to know how much you spent on groceries for your family dinner, guest dinner, snacks, and restaurants.

It will become your powerful habit. Do that for everyone else, and at the end of the month you will know where it is all going. A few months later, you will easily predict how much you need to pay your basic expenses.

Chapter Four: “How Much Is Enough? The Quest for Happiness”

Chapter 4, relaying on the previous chapter, talks deeper about your life habits, and spending. It has some important questions you need to answer, about your life purpose, and values. What makes you happy, can you buy it with money, and if you can, can you afford it?

If you cannot, how can you get that? Are you working on that, or are you working ‘for money/living’ without real purpose and without following your dreams? By reading this chapter, you become aware of your feelings for every category and subcategory from the previous chapter sheet.

Chapter Five: “Getting It Out in the Open”

Chapter 5 prepared you with one easy step to do: make a wall chart of your income and expenses by month.

Technically, you won’t get any new information about your money habit because you already calculated it through previous steps, but the difference is huge when you see it graphically. It will enforce you to think twice about your expenses, and to visualize your savings – by changing your habits.

Chapter Six: “The American Dream—on a Shoestring”

Chapter 6 teaches you how to value your life energy by minimizing your spending, looking for the quality of your life and needs, and not blindly following the standards society is imposing you on. You can reach this by choosing wisely and following these ten steps:

1. Don’t go shopping.

2. Live within your means.

3. Take care of what you have.

4. Wear it out.

5. Do it yourself.

6. Anticipate your needs.

7. Research value, quality, durability, multiple use, and price.

8. Buy it for less.

9. Meet your needs differently.

10. Follow the nine steps of this program.

Chapter Seven: “For Love or Money: Valuing Your Life Energy—Work and Income”

Chapter 7 talks about valuing your life energy, but this time not by cutting off your spending, but by maximizing your income. Simply, through this chapter, you will understand the main purpose of work, and it’s not universal, of course.

But the knowledge that work isn’t only your job you work to be paid for, but every work you are doing through your life, month, day, just because you love it, need to do it (like cleaning, cooking..).

You need to learn to value the energy you put into every single job and to make a maximum of your life because by valuing yourself, your energy, time, and life, you will find a job or a way to be paid proportionally for your effort.

Chapter Eight: “Catching Fire: The Crossover Point”

Chapter 8 talks about capital and defining your ‘enough’. It is the crossover point after which, when you reach that sum of money, you will be financially independent.

You will do it monthly, by investing a part of your income somewhere (and more about that in the next chapter). And adding it to your wallet chart, you will see how long you need to work unless you become independent.

Chapter Nine: “Where to Stash Your Cash for Long-Term Financial Freedom”

Chapter 9, as a last step of this program, assuming you reach financial independence, takes care about investing your money.

It provides examples and pieces of advice for investing, risk tolerance, and stories from attendees of this program. In summary, here is the checklist you want to consider before investing:

- Is this investment in line with my values?

2. Is this investment in line with my tolerance for risk?

3. Does this provide overall diversification for my investments?

4. Does this provide the current and future income I need?

5. How easily can I liquidate (sell out of) all or part of this investment?

6. What sales charges or penalties (if any) will I incur in getting into or out of this investment?

7. What are the federal, state, and local tax implications of this investment for me? (Is it tax efficient for my income bracket or situation?)

Most Important Keywords, Sentences, Quotes:

FOREWORD:

“There is really only one reason to read any book about money: to give yourself the gift of a better life.”

“The money part is definitely here. But the unique power of the method comes from working on the root of the problem—your personal beliefs and habits—rather than just the symptom of your monthly bank and credit card statements.”

CHAPTER ONE: “The Money Trap: The Old Road Map for Money”

““Your money or your life.” If someone thrust a gun in your ribs and said those words, what would you do? Most of us would turn over our wallets. The threat works because we value our lives more than we value our money. Or do we?”

“Along with racism and sexism, our society has a hidden hierarchy based on what you do for money. That’s called jobism, and it pervades our interactions with one another on the job, in social settings, and even at home. Why else would we consider stay-at-home moms second-class citizens?”

“For Americans (and increasingly for consumers in other nations) this “more is better” motto leads us to trade in our car every three years, buy new clothes for every event and every season, get a bigger and better house every time we can afford it, and upgrade everything from our TV to our smartphone simply because a new version has been released.”

CHAPTER TWO: “Money Ain’t What It Used to Be—and Never Was”

“Here’s the only thing you can say that is always true for you, one hundred percent of the time: Money is something you trade your life energy for. You sell your time for money.

It doesn’t matter that Ned over there sells his time for a hundred dollars and you sell yours for twenty dollars an hour. Ned’s money is irrelevant to you. The only real asset you have is your time. The hours of your life.”

““Knowing that money is simply your life energy puts you in the driver’s seat of your money life. How much of my life am I willing to sell to have money in my pocket?

Looking around at your accumulation of stuff you can ask, ‘How many hours of my life did I invest to have this . . . chair . . . car . . . matched set of cookware . . . diploma on the wall?’ See what this does to your next purchase.””

CHAPTER THREE: “Where Is It All Going?”

“A nationwide survey of American women conducted that same year by Consumer Reports National Research Center revealed that the average woman owns nineteen pairs of shoes—only four of which she wears regularly.”

“Over time as you do this step, not only will you refine your categories, you’ll find each one settles into a predictable range.

You will get clarity about your spending patterns and have an internally generated (rather than externally imposed) picture that is unique, deeply satisfying, and fluid as you grow and change and learn—a far cry from the old budget book categories.”

CHAPTER FOUR: “How Much Is Enough? The Quest for Happiness”

“Don’t ask yourself what the world needs, ask yourself what makes you come alive, and then go do it. Because what the world needs is people who have come alive.

—Howard Thurman, philosopher and theologian”

“Wherever you are, take a few moments now to reflect upon your dreams. Can you remember what you wanted before you were told to grow up and fit your round peg in a square cubicle? Use these questions to trigger memories and stimulate thoughts:

What did you want to be when you grew up?

What have you always wanted to do that you haven’t yet done?

What have you done in your life that you are really proud of?

If you knew you were going to die within a year, how would you spend that year?

What brings you the most fulfillment—and how is that related to money?

If you didn’t have to work for a living, what would you do with your time?”

“Our behavior is a concrete representation of our values. How we spend our time and money speaks volumes about who we are and what we stand for.”

CHAPTER FIVE: “Getting It Out in the Open”

“The Wall Chart reminds us that transforming our relationship with money doesn’t happen in a blaze of insight. You need to do the steps—faithfully—and that takes time and patience.

Impatience, denial, and greed are actually part of what is being transformed. It takes time to reflect on our lives and see if we still want to go where we’re headed. Reading this book may take only a few days, but transforming your relationship with money will happen over time.”

“Over time you may find that your feelings about your chart change as a reflection of changes in your relationship with money.

The chart becomes a representation of how well you are living your values, something that reflects the care you are taking with every decision about your material world. It becomes a source of pride—not arrogance, but that kind of deep satisfaction that comes with integrity.”

CHAPTER SIX: “The American Dream—on a Shoestring”

“That’s not just interesting, it’s transformative. Frugality means enjoying what we have. If you have ten dresses but still feel you have nothing to wear, you may be a compulsive shopper—the thrill of getting is greater than the joy of having and using.

But if you have ten dresses and have enjoyed wearing all of them for years, you are frugal. Waste lies not in the number of possessions but in the failure to enjoy them. Your success at being frugal is measured not by your penny-pinching but by your degree of enjoyment of the material world.”

“If you stop trying to impress other people you will save thousands, perhaps millions of dollars. If you must, impress people with how much money you saved with your creative DIY project or travel hack, or the natural beauty you experienced while camping instead of going to a resort.”

CHAPTER SEVEN: “For Love or Money: Valuing Your Life Energy—Work and Income”

“When “work = what you do for money,” it means the “work” of our free time is of lesser value. We fail to value our life energy and often feel helpless about making changes. What we will be exploring now is whether our definition of work itself is part of the problem.”

“A nationwide survey done by the Center for a New American Dream found that nearly half of Americans had made voluntary changes in their lives that resulted in making less money.

Those who did so reported being happy with the changes and said that the major motivations for making less money were reducing stress, striking a balance in their lives, and having more free time.”

CHAPTER EIGHT: “Catching Fire: The Crossover Point”

“The Crossover Point provides us with our final definition of Financial Independence.

At the Crossover Point, where monthly investment income exceeds your monthly expenses, you will be financially independent in the traditional sense of that term. You will have passive income from a source other than a job.”

“There is no formula for how you live after the Crossover Point. And that’s the point. You are free to invent your life. You are free to explore what Buckminster Fuller meant when he said, “We are called to be architects of the future, not its victims.””

CHAPTER NINE: “Where to Stash Your Cash for Long-Term Financial Freedom”

“If there are a few simple rules to remember from the Bogleheads, it’s the following:

- Pay off debt and avoid it in the future.

- Live below your means by spending less than you earn.

- Invest the rest in low-cost index funds.

- Hold on to funds for many years.”

Book Review (Personal Opinion):

This book changed my perception of money and financial success. I always thought that making money was a difficult thing to do and that is the whole life run.

In the end, this book proves that making money can’t be easier if you follow simple steps and make it a part of your life by valuing your life more than money.

My favorite thing about this book is the explanation of all steps through real-life examples and others’ experiences. It makes it easier to understand the task and gives you ideas to think about someone’s situation throughout your life, and maybe it will never come to your mind on your own.

Rating: 9/10

This Book Is For:

- People who think they don’t have enough money

- People who are overwhelmed with their jobs

- People whose job doesn’t reflect their values

If You Want To Learn More

Here is the official website where you can get more advice and blog posts:

https://yourmoneyoryourlife.com/

How I’ve Implemented The Ideas From The Book

Since this whole book is the program for changing your habits and vision you have about money and work, maybe it is not efficient enough to do just one small part or step from the whole book.

But I find it positive to build a habit of tracking my income and expenses, and it looks different when I know where and how much percentage wage you spend my money.

One Small Actionable Step You Can Do

Technically, this book is divided into the nine steps you need to do if you want to change your perspective about money and earnings. There is no magic formula to increase your income and have enough money.

You need to think about money and change your spending habits. But for begging, you can find the ‘Money talks’ paragraph at the end of every chapter and try to answer those questions or some of them. By reviewing your answers, you will get a lot of ideas on how to change your life and earn more.